Ether.fi, the largest liquid restaking protocol, saw its total value locked (TVL) reach a new record on Tuesday, hitting the $6 billion mark. The protocol’s TVL started the year at $100 million, and has since soared by 5,900%.

Ether.fi added $2 billion over the last two weeks alone as investors increased their staking bets amid bullish Ethereum trends.

On Thursday, May 23, the US Securities and Exchange Commission (SEC) green-lighted the trading of spot Ethereum exchange-traded funds (ETFs). The regulator approved requests from CBOE, Nasdaq, and NYSE exchanges to adjust existing rules to enable the trading of Ethereum ETFs and Exchange-Traded Products (ETPs). Individual ETF filings from the likes of VanEck and BlackRock are still in the queue, but this is already a victory for the crypto space.

The market factored in the SEC’s move about a week prior to its decision when the ETH price formed the largest daily green candle.

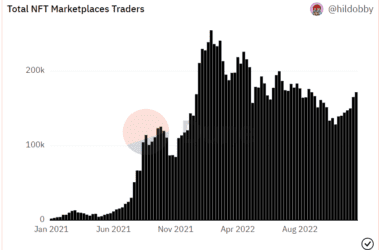

The staking and restaking ecosystems exploded with the ETH price as more investors are interested in securing ETH rewards.

Ether.fi is a decentralized liquid staking protocol that enables users to aim for higher staking rewards by repurposing ETH that is already staked. The restaking process is done through an underlying protocol called EigenLayer, which has become the second-largest DeFi project by TVL after Lido.

EigenLayer itself reached a new high on Tuesday at over $19.2 billion.

The liquid restaking market, which consists of decentralized protocols that leverage EigenLayer technology while offering liquid restaking tokens to be used in DeFi, has surged to over $13 billion.

Besides Ether.fi, the rest of restaking projects have expanded as well, with Renzo and Puffer Finance reaching $2.8 billion and $1.8 billion, respectively, and EigenPie crossing the $1 billion mark after a threefold increase over the last month.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!